Understanding FIVA

The Universal Need for Returns

Every person is interested in returns on their capital. In DeFi using blockchain, you can receive these returns by locking your capital, which then generates returns through various mechanisms. This yield in DeFi comes from different sources:

Trading fees and liquidations (Storm vaults)

Validation rewards from blockchain (Tonstakers)

Arbitrage of funding rates (Ethena)

Credit spread and money markets (EVAA)

Incentives and yield farming, etc.

For instance, if you have 1000 TON, you could stake them in Tonstakers and earn 4% APY (Annual Percentage Yield). This means that after one year, not only can you get your initial 1000 TON back, but you also earn an additional 40 TON — bringing your total to 1040 TON.

The Problem with Current DeFi

All these protocols issue yield-bearing tokens like tsTON (Tonstakers), Storm SLP, tsUSDe (staked USDe on TON from Ethena), etc. But these tokens provide volatile yield - today it's 10%, tomorrow it's 5%. Additionally, many protocols give you points or incentives of different kinds.

This makes staking really time-consuming for people who just want additional returns, and points farming expensive and capital-intensive.

The Solution: Yield Tokenization

To solve this problem, yield tokenization and creation of yield markets were invented. This idea was pioneered by Pendle Protocol.

Basically, yield tokenization takes yield-generating tokens and splits them into 2 parts:

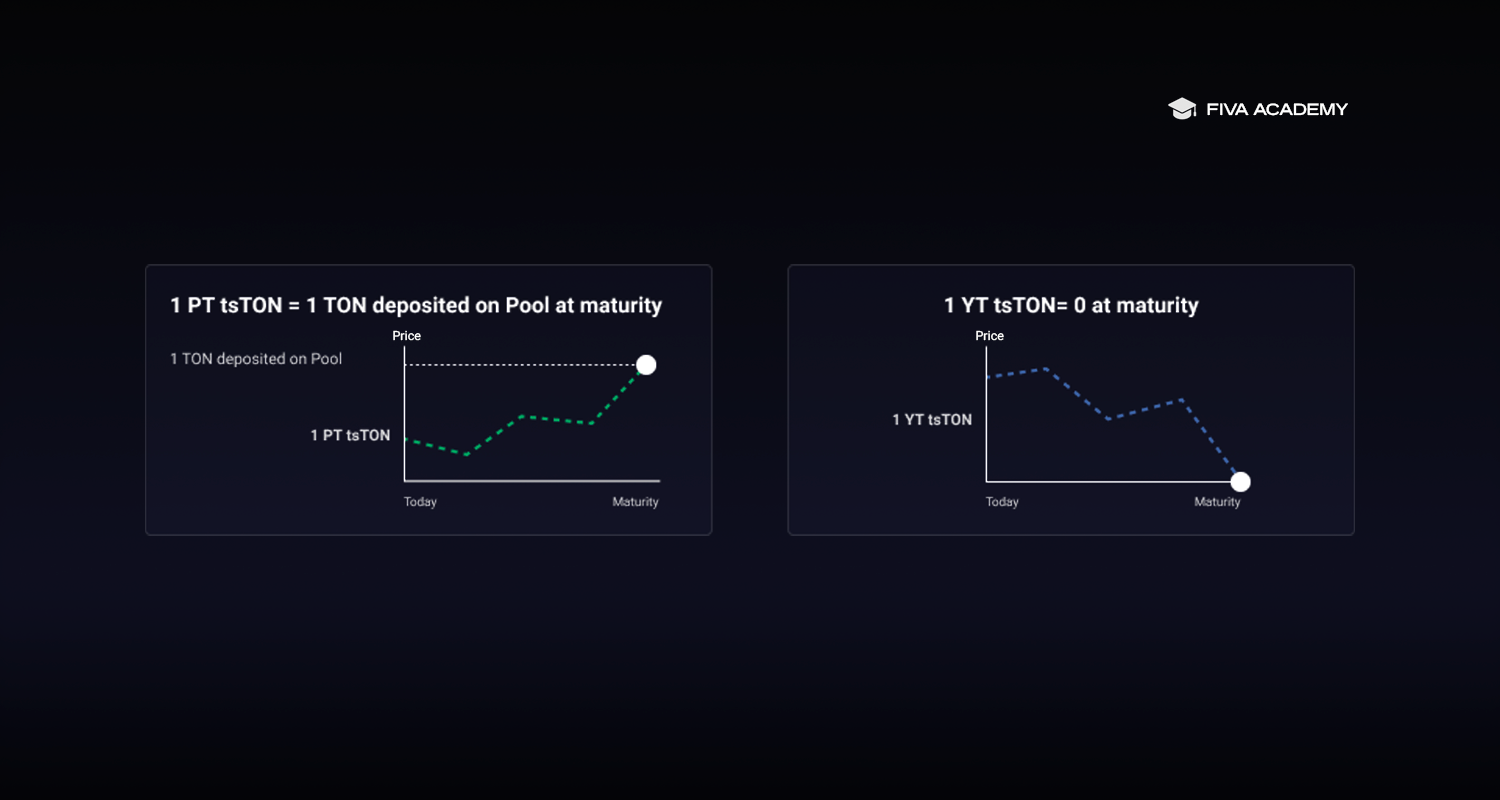

Principal Token (PT) - represents the base tokens (TON, USDT) that you lock to generate yield in underlying protocols

Yield Token (YT) - represents the yield that is generated by this principal

The rule here is simple:

YT + PT = Underlying Token

After that, FIVA creates a market where these tokens can be traded between each other: PT, YT, and underlying tokens (tsTON, tsUSDe, etc.). But in order to trade, you need to know the price of the token. Let’s be real — you can’t predict how much yield a protocol will generate over the next 10 years, so pricing the yield token might seem impossible.

That’s where maturity comes in. Maturity refers to the timeframe over which the yield token will generate yield. After that, the yield token stops earning yield. By introducing maturity, we allow the market to estimate the price of yield tokens and start trading them. Because YT + PT = Underlying Asset, knowing the price of the yield token and the underlying asset lets you determine the value of the principal token as well.

This creates a yield market, a brand-new concept for the TON ecosystem, allowing users to trade and manage yield while adding new utility to the ecosystem.

Use Cases Enabled by This Approach

This approach enables the following use cases that solve your problems:

For Point Farmers:

More fast and cheap way to farm points. These farmers buy the volatile yield part from other users, getting point exposure without locking full capital.

For Return-Oriented Users:

Fixed returns on their tokens (TON, USDT, ETH, BTC) - usually with higher percentage than in underlying protocols because of points and future rewards priced in by farmers.

For Arbitrageurs:

Interesting opportunities when the market hasn't properly priced future yield, creating profit opportunities.

For Liquidity Providers:

Additional way to generate returns on their assets - also volatile but with more potential upside (trading fees and FIVA incentives) and without impermanent loss.

The Bigger Vision

Generally, the idea is that by abstracting the difficulty of receiving yield to professionals (no need for point farming, claiming, and monitoring), providing the best UX (Telegram Mini Apps, no gas, no wallets needed), and using Telegram's distribution, we can onboard more people to DeFi and provide 5-20% returns on stablecoins for 1 billion Telegram users.

What This Means for You

Whether you're looking for:

Fixed, predictable returns → Buy PT tokens

Efficient points farming → Buy YT tokens

Enhanced yield on your assets → Provide liquidity

FIVA's yield tokenization makes sophisticated DeFi strategies accessible to everyone, from professional traders to everyday savers.

Last updated